9 Undeniable How To Backdoor Roth Ira - But it's a useful strategy to understand if your income is rapidly rising and you may be above the income limits for roth contributions. The backdoor roth takes advantage of this fact.

What You Should Know About Backdoor Roth IRAs vs . Backdoor roth ira // do you make too much to qualify for roth contributions?

What You Should Know About Backdoor Roth IRAs vs . Backdoor roth ira // do you make too much to qualify for roth contributions?

How to backdoor roth ira

5 Tricks How To Backdoor Roth Ira. If you fit that description, the Your money will simply grow tax free and be withdrawn tax free in retirement. A backdoor roth is a strategic conversion of your traditional ira into a roth ira. How to backdoor roth ira

And why you might want to include it in your 2022 financial plan. Simply stated, you contribute to a standard ira, convert your contributions to a roth ira, pay some taxes, and you’re done. As of january 2022, the future of backdoor roth ira is still in question, as congress is still hashing out the final details of the build back better framework.in the meantime, it is still possible to fund your backdoor roth How to backdoor roth ira

Through this post, we will cover the basics and help you determine whether a backdoor roth ira is a viable strategy for you. This shot is of my roth ira, which is entirely in the vanguard reit index fund. A backdoor roth ira is a legal way to get around the income limits. How to backdoor roth ira

Mutual fund account backdoor roth step 1: How to do a backdoor roth ira contribution safely. On day 3, you can finally choose the investment you want in the roth ira. How to backdoor roth ira

What a backdoor roth ira is & how to use it. You can also roll over more than the yearly contribution limit into a roth ira if the traditional ira has more. Just go into your roth ira account. How to backdoor roth ira

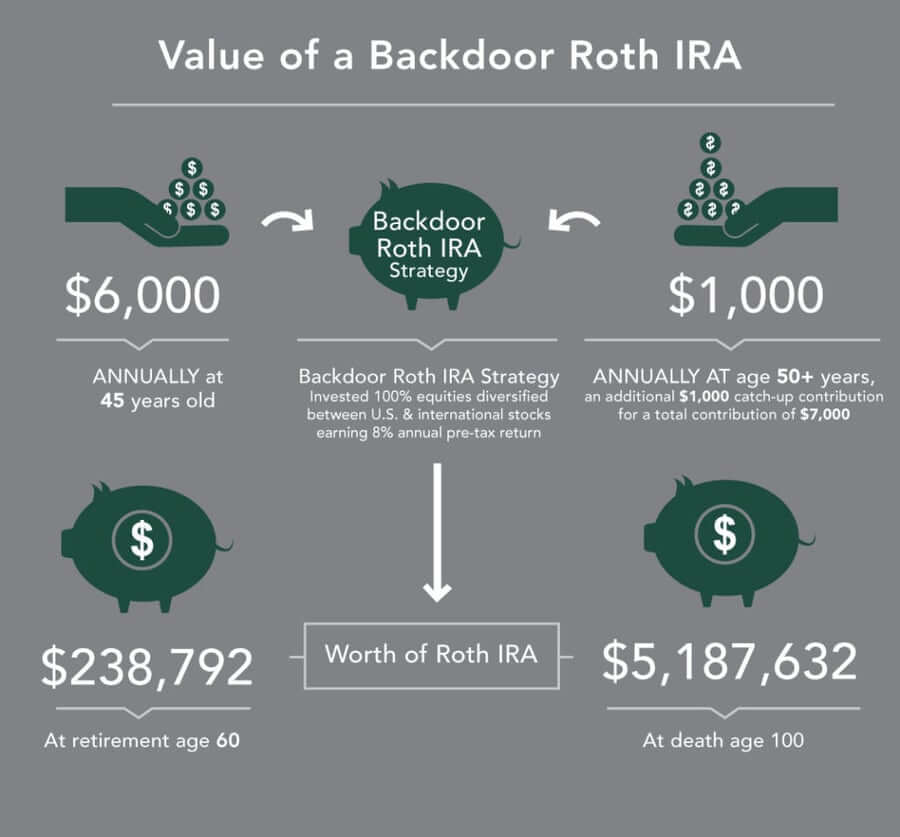

So i'm going to just add the $6,000 to that fund. The big benefit of a roth ira is. A backdoor roth ira allows people with high incomes to sidestep the. How to backdoor roth ira

If you are considering a backdoor roth ira, be aware that the u.s. It allows you to circumvent the roth income restrictions and contribute to the retirement vehicle even if you’re earning more than $135,000 a year. A popular tax strategy known as a “backdoor roth ira” just barely escaped the chopping block late last month. How to backdoor roth ira

A roth ira is similar to a traditional individual retirement account, but you fund it with money that’s already been taxed — meaning there’s no upfront tax break as there is with the traditional ira. You can see the $6,000 credit there. Any amount you contribute above. How to backdoor roth ira

If you have been grandfathered in with a mutual fund account and have resisted the many popups encouraging you to transition your ira to a brokerage account, i commend you. Here's a backdoor roth ira guide, including how they work, how to set one up, 3 situations where it might be a bad idea and how to follow the pro rata rule. In 2021 and 2022, you can contribute up to $6,000 each year to your ira, or $7,000 if you are 50 or older. How to backdoor roth ira

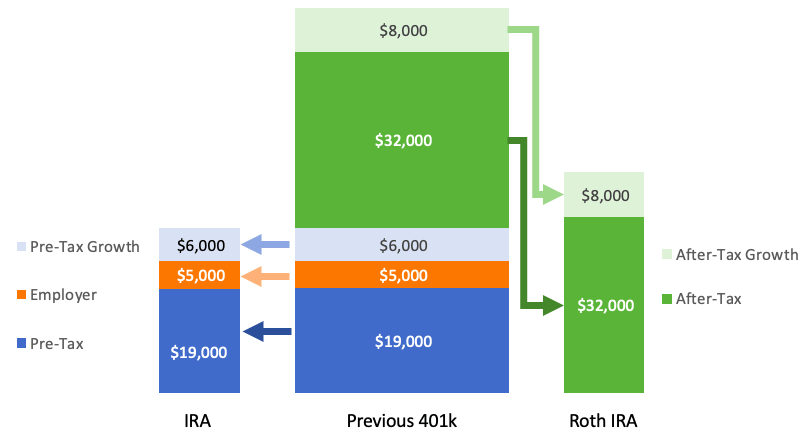

By doing a backdoor roth ira, you are not dodging taxes. Backdoor roth ira disadvantages the two big disadvantages to this strategy are the tax implications and the waiting period to access your money. If you aren’t familiar with this type of conversion, then here are few facts about it. How to backdoor roth ira

Roth iras have many advantages: When you consider building your nest egg, roth options can be extremely valuable. You can withdraw from your roth ira once you are 59.5. How to backdoor roth ira

A backdoor roth ira allows people with high incomes to sidestep the roth’s income limits. Backdoor roth ira contribution limits roth and traditional ira contribution limits are $6,000 for 2021. By converting the money from a traditional ira to a roth ira, you will owe the taxes on the amount transferred for that tax year. How to backdoor roth ira

You can still get the awesome tax savings via a backdoor roth ira! When you consider building your nest egg, roth options can be extremely valuable. A traditional ira, on the other hand, doesn’t limit or prevent people with higher incomes from contributing. How to backdoor roth ira

Congress may pass legislation that would reduce some of its benefits after 2021. Choose vanguard roth ira investments. Tax implications of a backdoor roth ira: How to backdoor roth ira

There might be some instances where you will need to pay taxes with a backdoor roth ira, such as: That usually prevent high earners from contributing to a roth ira. How to backdoor roth ira

Psst...the Backdoor Route to a Roth IRA WSJ . That usually prevent high earners from contributing to a roth ira.

Psst...the Backdoor Route to a Roth IRA WSJ . That usually prevent high earners from contributing to a roth ira.

Blog How to Do a Backdoor ROTH IRA in 3 Easy Steps . There might be some instances where you will need to pay taxes with a backdoor roth ira, such as:

Blog How to Do a Backdoor ROTH IRA in 3 Easy Steps . There might be some instances where you will need to pay taxes with a backdoor roth ira, such as:

How The Backdoor Roth IRA Contribution Works — Forbes . Tax implications of a backdoor roth ira:

How The Backdoor Roth IRA Contribution Works — Forbes . Tax implications of a backdoor roth ira:

What Is a Backdoor Roth IRA, and Should You Open One? . Choose vanguard roth ira investments.

What Is a Backdoor Roth IRA, and Should You Open One? . Choose vanguard roth ira investments.

Backdoor Roth IRA 2021 A Step by Step Guide with Vanguard . Congress may pass legislation that would reduce some of its benefits after 2021.

Backdoor Roth IRA 2021 A Step by Step Guide with Vanguard . Congress may pass legislation that would reduce some of its benefits after 2021.

E. Backdoor Roth How to use your IRA even if you’re over . A traditional ira, on the other hand, doesn’t limit or prevent people with higher incomes from contributing.

E. Backdoor Roth How to use your IRA even if you’re over . A traditional ira, on the other hand, doesn’t limit or prevent people with higher incomes from contributing.