5 Hidden How To Back Door Roth Ira Work

8 Proven How To Back Door Roth Ira - For 2022, if you have a modified adjusted gross income (magi) of $144,000 or more filing singly, or $214,000 or more filing jointly, then you are prohibited from contributing to one. By using this service, you agree to.

How To Do A Backdoor Roth IRA Contribution (Safely) . If you are single, and earn above $125,000 but less than $140,000, you can still contribute to a roth ira, but not the full $6,000 limit.

How To Do A Backdoor Roth IRA Contribution (Safely) . If you are single, and earn above $125,000 but less than $140,000, you can still contribute to a roth ira, but not the full $6,000 limit.

How to back door roth ira

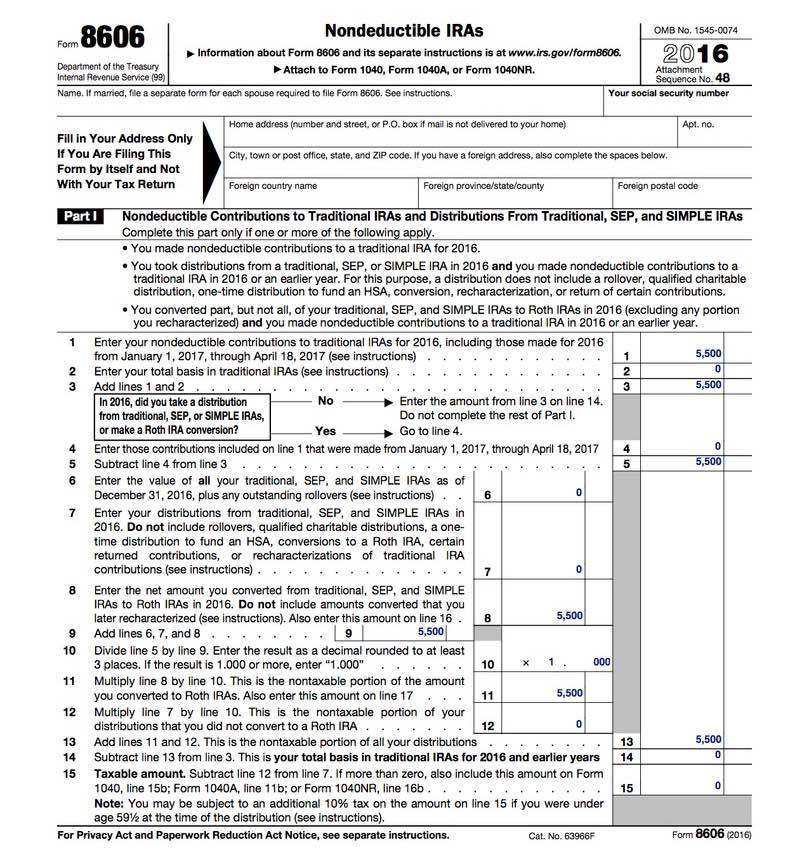

10 Useful How To Back Door Roth Ira. You still may be able to benefit from a roth ira by entering through the “back door.”. Form 8606 asks about the total value of your sep, simple, and traditional iras at the end of the tax year. Here's a backdoor roth ira guide, including how they work, how to set one up, 3 situations where it might be a bad idea and how to follow the pro rata rule. How to back door roth ira

A roth ira is similar to a traditional individual retirement account, but you fund it with money that’s already been taxed — meaning there’s no upfront tax break as there is with the traditional ira. Tax implications of a backdoor roth ira: Congress may pass legislation that would reduce some of its benefits after 2021. How to back door roth ira

So if you want to open an account and then use. There might be some instances where you will need to pay taxes with a backdoor roth ira, such as: If you are considering a backdoor roth ira, be aware that the u.s. How to back door roth ira

With a traditional ira, contributions may be partially or fully deductible, depending on your modified adjusted. If you are eligible for a roth ira, you can certainly open and make future contributions to this account. To avoid unintended taxation, don’t open a traditional, sep, or simple ira after you complete the backdoor roth until the next tax year. How to back door roth ira

The downside is that you will have to pay taxes on the money you transfer into a roth ira. First, let’s quickly review the basics. In 2021 and 2022, you can contribute up to $6,000 each year to your ira, or $7,000 if you are 50 or older. How to back door roth ira

The big benefit of a roth ira is. But roth iras have a big drawback: Tax implications of a backdoor roth ira: How to back door roth ira

Learn how to use the mega backdoor roth ira to super charge your retirement savings. A backdoor roth ira allows people with high incomes to sidestep the. There might be some instances where you will need to pay taxes with a backdoor roth ira, such as: How to back door roth ira

When you consider building your nest egg, roth options can be extremely valuable. Go through the back door by putting your money into a traditional ira and then converting the money over to a roth. You want that number to be $0. How to back door roth ira

Once you reach the maximum limit, you can convert your 401 (k into a roth. At this time, ellevest doesn't support back door roth iras or ira conversions. What a backdoor roth ira is & how to use it. How to back door roth ira

Important legal information about the email you will be sending. If it isn’t, you may face tax consequences. A method that taxpayers can use to place retirement savings in a roth ira , even if their income is higher than the maximum the irs allows for. How to back door roth ira

In this video, we provide a step by guide on this 100% legal tax loophol. When you consider building your nest egg, roth options can be extremely valuable. You can use a mega backdoor roth to make extra contributions to your 401 (k. How to back door roth ira

A roth ira phase out is the range in which the government phases out your ability to contribute to a roth ira. If you earn too much to contribute directly to a roth ira, there are still ways to move funds to this type of an account. That usually prevent high earners from contributing to a roth ira. How to back door roth ira

A backdoor roth ira allows people with high incomes to sidestep the roth’s income limits. Contributing to a roth ira through the back door is more complicated than contributing the straightforward way, but it’s your only option if. We filter out sleazy advisors. How to back door roth ira

You’ll need to make sure that you keep your employer’s matching contributions out of your 401 (k. Ira and 401 (k) rules disallow more than $6,000 and $19,500. A backdoor roth ira is a legal way to get around the income limits. How to back door roth ira

How to do backdoor Roth IRA Roth ira, Ira contribution . A backdoor roth ira is a legal way to get around the income limits.

How to do backdoor Roth IRA Roth ira, Ira contribution . A backdoor roth ira is a legal way to get around the income limits.

Ok can someone explain this mega back door Roth IRA . Ira and 401 (k) rules disallow more than $6,000 and $19,500.

Ok can someone explain this mega back door Roth IRA . Ira and 401 (k) rules disallow more than $6,000 and $19,500.

Backdoor Roth IRA A HowTo Guide The Biglaw Investor . You’ll need to make sure that you keep your employer’s matching contributions out of your 401 (k.

Backdoor Roth IRA A HowTo Guide The Biglaw Investor . You’ll need to make sure that you keep your employer’s matching contributions out of your 401 (k.

What is a Backdoor Roth IRA Conversion? (With images . We filter out sleazy advisors.

What is a Backdoor Roth IRA Conversion? (With images . We filter out sleazy advisors.

BackDoor Roth IRA Tutorial . Contributing to a roth ira through the back door is more complicated than contributing the straightforward way, but it’s your only option if.

BackDoor Roth IRA Tutorial . Contributing to a roth ira through the back door is more complicated than contributing the straightforward way, but it’s your only option if.

The Backdoor Roth Investing in a Roth IRA for High Earners . A backdoor roth ira allows people with high incomes to sidestep the roth’s income limits.

The Backdoor Roth Investing in a Roth IRA for High Earners . A backdoor roth ira allows people with high incomes to sidestep the roth’s income limits.