13 Useful How To Calculate The Terminal Value Free

9 Convert How To Calculate The Terminal Value - There are several terminal value formulas for calculating what a business will be worth in three or five years. The dcf formula takes the terminal value and discounts it.

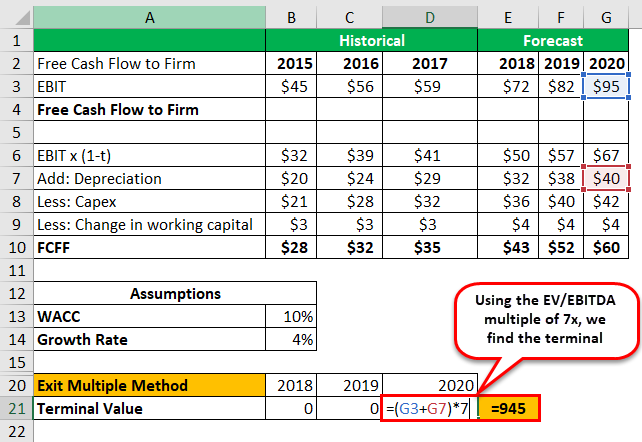

DCF Terminal Value Formula How to Calculate Terminal . Since the dcf values cash flow available to all providers of capital, ev multiples are generally used rather than equity value multiples.

DCF Terminal Value Formula How to Calculate Terminal . Since the dcf values cash flow available to all providers of capital, ev multiples are generally used rather than equity value multiples.

How to calculate the terminal value

10 Studies How To Calculate The Terminal Value. In the subsequent step, we can now figure out the implied growth rate under the exit multiple approach. The present value (pv) of the terminal value is then added to the pv of the free cash flows in the projection period to arrive at an implied firm value. Calculate the net present value. How to calculate the terminal value

Terminal value is the value of a security or a project at some future date beyond which more precise cash flows projection is possible. For example, for valuation purposes, the company can use two methodologies to calculate the terminal value. To determine the present value of the terminal value, one must discount its value at t0 by a factor equal to the number of years included in the initial projection period. How to calculate the terminal value

How to calculate terminal value. In other words, suppose you had initially forecast an investment five years into the future,. What are 3 ways to value a company? How to calculate the terminal value

The terminal value calculation estimates the value of the company after the forecast period. In our use, we are using it to find the terminal value of a going concern or company sold in the stock market. In this video on terminal value formula, here we discuss how to calculate the terminal value using method of perpetuity growth and exit multiple growths with. How to calculate the terminal value

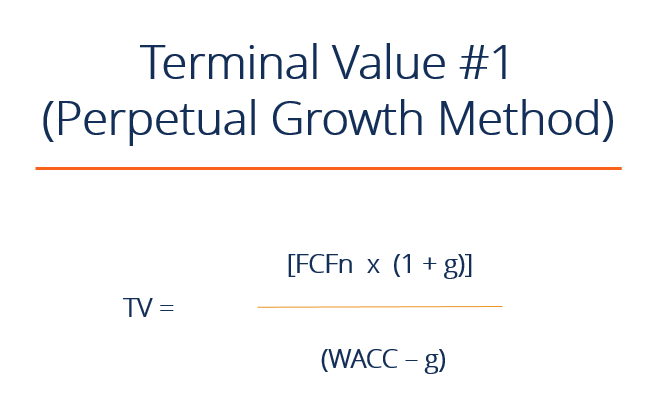

The formula to calculate the terminal value is: The terminal value calculation estimates the value of the company after the forecast period. The terminal value of the subsidiary is $353,894,737. How to calculate the terminal value

It should also be noted that the growth rate is always lower than the projected growth. Starting with the growth in perpetuity approach, we can back out the implied exit multiple by dividing the terminal value in year 5 ($492mm) by the final year ebitda ($60mm), which comes out to an implied exit multiple of 8.2x. Do you need to discount the terminal value? How to calculate the terminal value

You need to determine 4 of the following figures before proceeding further: Investors and lenders use them to calculate discounted cash flow. You can find the appropriate multiples by searching for similar companies to michael hill, also called “comparable public companies” or “public comps.” How to calculate the terminal value

This means that the future value of the company, in today’s money value is $353, 894,737. It is also called horizon value or continuing value. The exit multiple method assumes the business is sold for a multiple of some metric (e.g., ebitda ebitda ebitda or earnings before interest, tax, depreciation, amortization is a company's profits before any of these net deductions are made. How to calculate the terminal value

There are two methods used to calculate the terminal value, which depends on the type of analysis to be done. The terminal value is typically calculated by applying an appropriate multiple (ev/ebitda, ev/ebit, etc.) to the relevant statistic projected for the last projected year. A complete guide on how to calculate roi uses the present to predict the future How to calculate the terminal value

We can calculate the terminal value as: (1) dcf analysis, (2) comparable company. In this video on terminal value, we are going to learn this topic in detail including its formula, examples and calculation in excel.𝐖𝐡𝐚𝐭 𝐢𝐬 𝐓𝐞𝐫𝐦𝐢. How to calculate the terminal value

Valuation methods when valuing a company as a going concern, there are three main valuation methods used by industry practitioners: The formula to calculate terminal value is: We calculate the terminal value in accordance with a stream of projected future free cash flows in discounted cash flow analysis. How to calculate the terminal value

The terminal value calculation can also help you encourage investors in your company by showing the value their investment might have in the future. How to calculate the terminal value

Terminal Value Formula 2 Methods to Calculate Terminal Value . The terminal value calculation can also help you encourage investors in your company by showing the value their investment might have in the future.

Terminal Value Formula 2 Methods to Calculate Terminal Value . The terminal value calculation can also help you encourage investors in your company by showing the value their investment might have in the future.

Terminal Value (Definition, Example) What is DCF . We calculate the terminal value in accordance with a stream of projected future free cash flows in discounted cash flow analysis.

Terminal Value (Definition, Example) What is DCF . We calculate the terminal value in accordance with a stream of projected future free cash flows in discounted cash flow analysis.

Ppv Formula Frontiers Sensitivity, Specificity, and . The formula to calculate terminal value is:

Terminal Value Formula 2 Methods to Calculate Terminal Value . Valuation methods when valuing a company as a going concern, there are three main valuation methods used by industry practitioners:

Terminal Value Formula 2 Methods to Calculate Terminal Value . Valuation methods when valuing a company as a going concern, there are three main valuation methods used by industry practitioners:

How to Calculate the DCF Terminal Value Formula Eloquens . In this video on terminal value, we are going to learn this topic in detail including its formula, examples and calculation in excel.𝐖𝐡𝐚𝐭 𝐢𝐬 𝐓𝐞𝐫𝐦𝐢.

How to Calculate the DCF Terminal Value Formula Eloquens . In this video on terminal value, we are going to learn this topic in detail including its formula, examples and calculation in excel.𝐖𝐡𝐚𝐭 𝐢𝐬 𝐓𝐞𝐫𝐦𝐢.

Terminal Value Formula 2 Methods to Calculate Terminal Value . (1) dcf analysis, (2) comparable company.

Terminal Value Formula 2 Methods to Calculate Terminal Value . (1) dcf analysis, (2) comparable company.