8 Popular How To Avoid Capital Gains Tax On Sale Of Business Free

8 Jackpot How To Avoid Capital Gains Tax On Sale Of Business - Section 1202 capital gains exclusion. Cgt is the tax that you pay on any capital gain.

How to Reduce or Avoid Capital Gains Tax on Property or . And because it had grown to such a high value they were going to.

How to Reduce or Avoid Capital Gains Tax on Property or . And because it had grown to such a high value they were going to.

How to avoid capital gains tax on sale of business

8 Safe How To Avoid Capital Gains Tax On Sale Of Business. If your income is over $418,400, then you pay 20% tax. How to calculate capital gains tax on the sale of property. If you have funds in an old. How to avoid capital gains tax on sale of business

I had a particular client wishing to sell their business. To prepare for a business sale, you need to understand the capital gains on selling a business, how they impact a sale, and how to reduce the tax on capital gains. The tax that is then levied on the profit portion of your sale is called capital gains tax. How to avoid capital gains tax on sale of business

Capital gains tax on the sale of a business can be significant, but the good thing is that there are ways to avoid paying this hefty price. That is 20% of $100,000, which is $20,000. Depending on how your gains are classified, and. How to avoid capital gains tax on sale of business

In canada, you only pay tax on 50% of any capital gains you realize. In this case, each partner might have capital gains of $25,000. If you’re in the 37% ordinary income tax bracket, you’ll likely end up with a 20% net. How to avoid capital gains tax on sale of business

This can include the sale of shares for example, or the sale of a business, inherited properties or second homes. An asset can include a business, land, share on the stock, etc. Opposite to a capital gain is a capital loss. How to avoid capital gains tax on sale of business

Call us at 1.855.724.6228 contact Therefore, if you’ve had your business for over one year and then you sell the assets, the amount of income you. Understanding the tax consequences of a business sale can be tricky, but it needs to be part How to avoid capital gains tax on sale of business

So, the answer to how to avoid capital gains tax is as simple as waiting until you’ve owned the property for more than one year. It can apply to any valuables you might own over a certain value if you sell them at. It's not a separate tax, just part of your income tax. How to avoid capital gains tax on sale of business

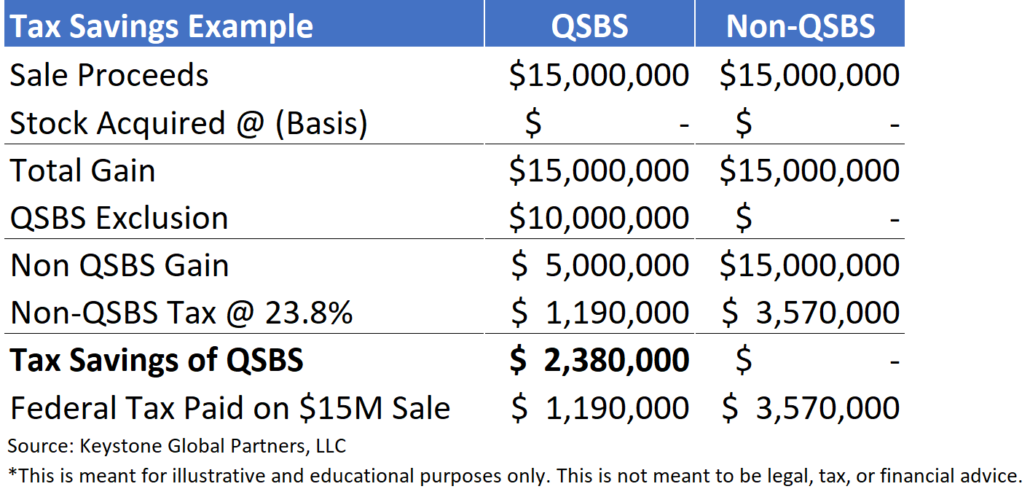

To calculate your capital gain or loss, simply subtract your adjusted base cost (abc) from your. If your business sells an asset, such as property, you usually make a capital gain or loss. Section 1202 allows small business owners to exclude at least 50% of the gain recognized on the sale or exchange of qualified small business stock (qsbs) that is held for five years or longer. How to avoid capital gains tax on sale of business

Most taxpayers won’t have to pay more than 15% tax on their capital gains.[1] per the irs, if you’re in the 10% to 12% ordinary income tax bracket, your net capital gain tax rate is likely 0%, meaning you don’t pay any taxes on your capital gains. Keeping your profits below this threshold is an excellent way to avoid capital gains tax on property. For instance, if you buy a stock for $8000 and three years later you're selling that stock for $12000, the increase of $4000. How to avoid capital gains tax on sale of business

If your income is between $37,951 and $418,400, then you only pay 15% tax. Though it is not for everyone, it can be a great method if you’re looking for ways to avoid capital gains tax on a business sale. If your asset class and income put you in the 20% nebraska capital gains tax bracket, you would pay 20% of your profit. How to avoid capital gains tax on sale of business

Capital gains taxes may be due on any gain received from the sale of the individual's partnership interest or from the sale of the partnership as a whole. You don’t need to pay 20% on the entire $350,000 sale since you had to spend $250,000 to purchase the asset. Although the rates you pay are dependent on your tax bracket and how long you’ve owned the business, you’re still going to land a hefty bill that will take a bite out of your lump sum profit. How to avoid capital gains tax on sale of business

Knowing what the threshold is going into the year allows you to make. Capital gains tax is a form of government taxation relating to gains made on the value of assets (things that you own) held for more than one year. Estate or invest in various real estate projects. How to avoid capital gains tax on sale of business

Capital gain tax usually occurs when a business owner sells its asset (business) for a higher price than they purchased it (which is the basis of its tax). Section 1202 of the internal revenue code permits stock owners to exclude the gain from selling qualified small business stock (qsbs) from their taxable income. This gain is limited to the greater of $10 million or 10 times their basis in the stock. How to avoid capital gains tax on sale of business

The greater of $10 million or ten times the stockholder's adjusted basis in the stock—usually the amount they paid to buy it—avoids capital gains tax entirely. Capital gains tax for business. This is the difference between what it cost you and what you get when you sell (or dispose of) it. How to avoid capital gains tax on sale of business

How To Avoid Capital Gains Tax On Business Sale . This is the difference between what it cost you and what you get when you sell (or dispose of) it.

How To Avoid Capital Gains Tax On Business Sale . This is the difference between what it cost you and what you get when you sell (or dispose of) it.

Selling your property? Here’s how to avoid Capital Gains . Capital gains tax for business.

Selling your property? Here’s how to avoid Capital Gains . Capital gains tax for business.

How To Avoid Capital Gains Tax On The Sale Of A Business . The greater of $10 million or ten times the stockholder's adjusted basis in the stock—usually the amount they paid to buy it—avoids capital gains tax entirely.

How To Avoid Capital Gains Tax On The Sale Of A Business . The greater of $10 million or ten times the stockholder's adjusted basis in the stock—usually the amount they paid to buy it—avoids capital gains tax entirely.

How to build or invest in a startup without paying capital . This gain is limited to the greater of $10 million or 10 times their basis in the stock.

How to build or invest in a startup without paying capital . This gain is limited to the greater of $10 million or 10 times their basis in the stock.

3 Ways to Avoid Capital Gains Tax on Second Homes wikiHow . Section 1202 of the internal revenue code permits stock owners to exclude the gain from selling qualified small business stock (qsbs) from their taxable income.

3 Ways to Avoid Capital Gains Tax on Second Homes wikiHow . Section 1202 of the internal revenue code permits stock owners to exclude the gain from selling qualified small business stock (qsbs) from their taxable income.

How to Reduce or Avoid Capital Gains Tax on Property or . Capital gain tax usually occurs when a business owner sells its asset (business) for a higher price than they purchased it (which is the basis of its tax).

How to Reduce or Avoid Capital Gains Tax on Property or . Capital gain tax usually occurs when a business owner sells its asset (business) for a higher price than they purchased it (which is the basis of its tax).