13 Trusting How To Calculate Interest On A Payment Full

13 Innovative How To Calculate Interest On A Payment - Divide your interest rate by the number of payments you’ll make in the year (interest rates are expressed annually). Multiply it by the balance of your loan, which for the first payment, will be your whole principal amount.

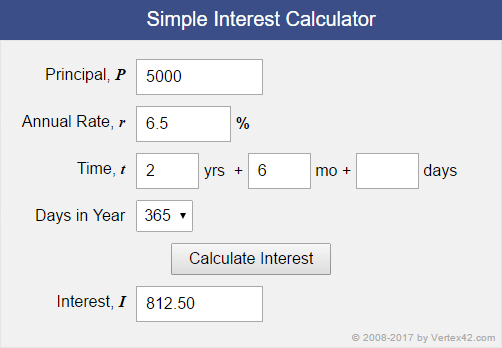

House Loan Limit Calculator Home Sweet Home Modern . Our loan interest calculator can help you determine the total interest over the life of your loan, as well as average.

House Loan Limit Calculator Home Sweet Home Modern . Our loan interest calculator can help you determine the total interest over the life of your loan, as well as average.

How to calculate interest on a payment

9 Undeniable How To Calculate Interest On A Payment. This doesn't give you the compounded interest Given a constant payment, calculate the balloon payment. Full usage instructions are in the tips tab below. How to calculate interest on a payment

Enter the interest payment formula. The rate you can charge varies from state to state, so be sure to check with your accountant for your state's usury limits. $100,000, the amount of the loan. How to calculate interest on a payment

For example, it can calculate interest rates in situations where car dealers only provide monthly payment information and total price without including the actual rate on the car loan. For example, if you take out a. 0.0083 x $2,000 = $16.60 per month. How to calculate interest on a payment

And d is the number of days for which interest is being calculated. For example, you might want to calculate mortgage interest for a mortgage of $500,000 with monthly payments of $2,500 at a 3% mortgage rate. If you pay that amount the first $83 goes to interest and the principal is reduced by $294. How to calculate interest on a payment

Given a balloon payment, calculate constant payments. For example, if payment is due on april 1 and the payment is not made until april 11, a simple interest calculation will determine the amount of interest owed to the vendor for the late payment. For example, you sign a credit card installment agreement, and you will pay your bill of $2,000 in 12 months with annual interest rate of 9.6%.in this example, you can apply the ipmt function to calculate the interest payment per How to calculate interest on a payment

For your convenience we list current redmond mortgage rates to help you perform. Our site also offer specific calculators for auto loans & mortgages. You can calculate your total interest by using this formula: How to calculate interest on a payment

With a simple interest loan, the amount you're borrowing is the principal, the length of the loan is the term, the money you pay for the privilege of borrowing is the interest and the date on which the loan is to be paid in full is its maturity date. How to calculate late payment interest before you can calculate interest on an overdue invoice, you must first determine the penalty apr. To calculate interest paid on a mortgage, you will first need to know your mortgage balance, the amount of your monthly mortgage payment, and your mortgage interest rate. How to calculate interest on a payment

0.0083 x 100 = 0.83%. = $10,645.08 solve on a ti ba ii plus be sure p/y is set to 12 for The choice of the method depends on the certainty of cash flows. How to calculate interest on a payment

To calculate the monthly interest on $2,000, multiply that number by the total amount: 360 (12 monthly payments per year times 30 years) here's how the math works out: Calculate monthly payments for a loan using our free calculator. How to calculate interest on a payment

Now divide that number by 12 to get the monthly interest rate in decimal form: Simple interest loans are common in everything from a home mortgage to a personal loan. These amounts reflect the amount which would need to be paid in order to maintain a constant principal balance. How to calculate interest on a payment

This financial planning calculator will figure a loan's regular monthly, biweekly or weekly payment and total interest paid over the duration of the loan. R is the prompt payment interest rate; How much interest will i have to pay? How to calculate interest on a payment

So, for example, if you’re making monthly payments, divide by 12. For example, if you borrowed $20,000 for 60 months and your apr was 5%, your payment would be $377.42. Create a loan repayment amortization schedule. How to calculate interest on a payment

Now that you know how to calculate your monthly payment, and understand how much loan you can afford, it's crucial you have a game plan for paying off your loan. Type =ipmt(b2, 1, b3, b1) into cell b4 and press enter. Making an extra payment on your loan is the best way to save on interest (provided there isn't a prepayment penalty). How to calculate interest on a payment

Find payment, principal, interest rate and term. The interest rate calculator determines real interest rates on loans with fixed terms and monthly payments. How to calculate principal and interest get a handle on what a loan costs you each month by daniel kurt full bio linkedin daniel kurt is an expert on retirement planning, insurance, home ownership. How to calculate interest on a payment

Principal loan amount x interest rate x time (aka number of years in term) = interest. To calculate the monthly payment, convert percentages to decimal format, then follow the formula: Doing so will calculate the amount that you'll have to pay in interest for each period. How to calculate interest on a payment

Convert the monthly rate in decimal format back to a percentage (by multiplying by 100): 0.005 (6% annual rate—expressed as 0.06—divided by 12 monthly payments per year) n: How to calculate interest on a payment

How to Calculate interest on a loan payment in MS Excel . 0.005 (6% annual rate—expressed as 0.06—divided by 12 monthly payments per year) n:

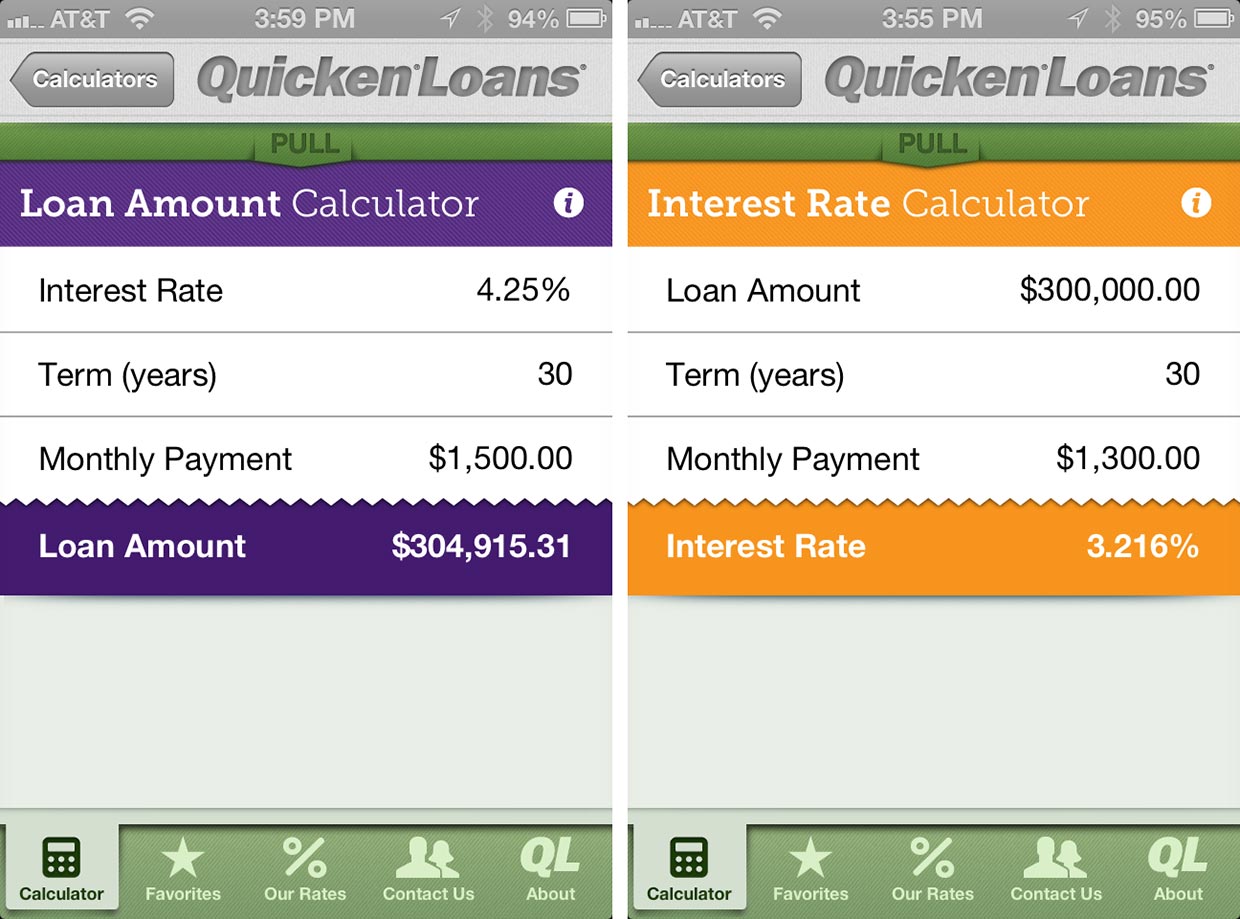

Mortgage Calculator by Quicken Loans for iPhone review iMore . Convert the monthly rate in decimal format back to a percentage (by multiplying by 100):

Mortgage Calculator by Quicken Loans for iPhone review iMore . Convert the monthly rate in decimal format back to a percentage (by multiplying by 100):

4 Ways to Calculate Compound Interest Payments wikiHow . Doing so will calculate the amount that you'll have to pay in interest for each period.

4 Ways to Calculate Compound Interest Payments wikiHow . Doing so will calculate the amount that you'll have to pay in interest for each period.

Come Calcolare un Pagamento degli Interessi con Microsoft . Principal loan amount x interest rate x time (aka number of years in term) = interest.

Do you understand your loan rates? Over 40 in the UAE don . How to calculate principal and interest get a handle on what a loan costs you each month by daniel kurt full bio linkedin daniel kurt is an expert on retirement planning, insurance, home ownership.

Do you understand your loan rates? Over 40 in the UAE don . How to calculate principal and interest get a handle on what a loan costs you each month by daniel kurt full bio linkedin daniel kurt is an expert on retirement planning, insurance, home ownership.