7 Genius How To Calculate My Paycheck Free

8 Excellent How To Calculate My Paycheck - Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. How to calculate w2 wages from a paystub because a w2 form tells you how much taxes have been taken out of your paycheck, it also tells you how much net income you've made throughout the year but, waiting around for

Enter Prior Payrolls . To calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year.

How to calculate my paycheck

7 Trustworthy How To Calculate My Paycheck. Can i contribute my blog related to the alternatives to state of california paycheck calculator ? Small businesses need to calculate withholding tax to know how much money they should take from employee paychecks to send to the internal revenue service to cover tax payments. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. How to calculate my paycheck

Only the medicare hi tax is applicable to the remaining four pay periods, so the withholding is reduced to $6,885 x 1.45%, or $99.83. Usage of the payroll calculator. This calculator is intended for use by u.s. How to calculate my paycheck

This federal hourly paycheck calculator is perfect for those who are paid on an hourly basis. If you were a contractor or freelancer, you would have to calculate this amount and pay it yourself, but your companys payroll administrator does it for you as an employee. For example, if an employee earns $1,500 per week, the individual’s annual income would be 1,500 x 52 = $78,000. How to calculate my paycheck

The calculator is updated with the tax rates of all canadian provinces and territories. Once you’ve gone through the previous eight steps and have figured out your gross income, withheld taxes, and other deductions, you have all you need to calculate your paycheck. Multiply the result by 100 […] How to calculate my paycheck

Divide the total of your tax deductions by your total, or gross, pay. The amount can be hourly, daily, weekly, monthly or even annual earnings. Each recommendation for state of california paycheck calculator will be attached with links, those links will lead you to the source page of the services, or products, etc., you can get more information at that source fastly. How to calculate my paycheck

Taxes can include fica taxes (medicare and Thats because your employer deducted the taxes you owe the federal government. Fill in the employee’s details. How to calculate my paycheck

How to calculate taxes taken out of a paycheck. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local w4 information. Divide the sum of all assessed taxes by the employee’s gross pay to determine the percentage of taxes deducted from a paycheck. How to calculate my paycheck

Calculate your fica taxes, otherwise known as your contribution to social security and medicare. Everyone pays a flat, 7.65% rate on the first $142,800 of earned income in the 2021 tax year (or on the first $147,000 in 2022). Your paycheck hits your account, but you dont see $1,200 you see something closer to $950. How to calculate my paycheck

This free paycheck calculator makes it easy for you to calculate pay for all your workers, including hourly wage earners and salaried employees. This is how you calculate your paycheck: Since $142,800 divided by $6,885 is 20.7, this threshold is reached after the 21st paycheck. How to calculate my paycheck

If you’d like to calculate the overall percentage of tax deducted from your paycheck, first add up the dollar amounts of each tax withheld. For the first 20 pay periods, therefore, the total fica tax withholding is equal to + , or $526.70. 🇺🇸 federal paycheck calculator calculate your take home pay after federal, state & local taxes updated for tax year 2022 united states federal income tax all residents and citizens in the usa are subjected to income. How to calculate my paycheck

You can use the calculator to compare your salaries between 2017 and 2022. Bankrate.com provides a free payroll deductions calculator and other paycheck tax calculators to help consumers determine the change in take home pay. How do i calculate the percentage of taxes taken out of my paycheck? How to calculate my paycheck

Earning Calculating Your Pay The Disney College Program . How do i calculate the percentage of taxes taken out of my paycheck?

Earning Calculating Your Pay The Disney College Program . How do i calculate the percentage of taxes taken out of my paycheck?

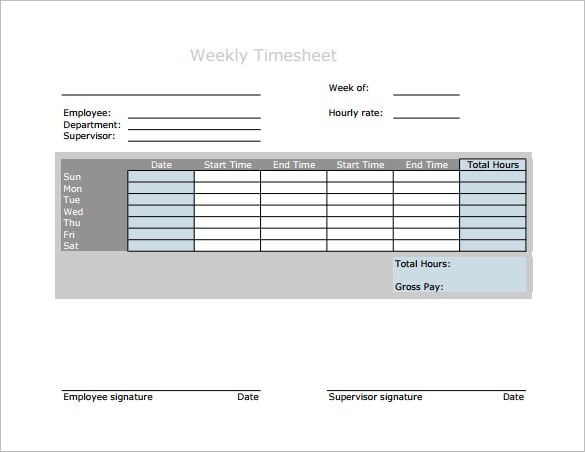

7+ Weekly Paycheck Calculator DOC, Excel, PDF Free . Bankrate.com provides a free payroll deductions calculator and other paycheck tax calculators to help consumers determine the change in take home pay.

7+ Weekly Paycheck Calculator DOC, Excel, PDF Free . Bankrate.com provides a free payroll deductions calculator and other paycheck tax calculators to help consumers determine the change in take home pay.

Earning Calculating Your Pay The Disney College Program . You can use the calculator to compare your salaries between 2017 and 2022.

Earning Calculating Your Pay The Disney College Program . You can use the calculator to compare your salaries between 2017 and 2022.

Paycheck Calculator Paystub Maker Download it now . 🇺🇸 federal paycheck calculator calculate your take home pay after federal, state & local taxes updated for tax year 2022 united states federal income tax all residents and citizens in the usa are subjected to income.

Paycheck Calculator Paystub Maker Download it now . 🇺🇸 federal paycheck calculator calculate your take home pay after federal, state & local taxes updated for tax year 2022 united states federal income tax all residents and citizens in the usa are subjected to income.

With Free Pay stub generator, you can make Free Paycheck . For the first 20 pay periods, therefore, the total fica tax withholding is equal to + , or $526.70.

With Free Pay stub generator, you can make Free Paycheck . For the first 20 pay periods, therefore, the total fica tax withholding is equal to + , or $526.70.

Free Paycheck Calculator Instructions YouTube . If you’d like to calculate the overall percentage of tax deducted from your paycheck, first add up the dollar amounts of each tax withheld.

Free Paycheck Calculator Instructions YouTube . If you’d like to calculate the overall percentage of tax deducted from your paycheck, first add up the dollar amounts of each tax withheld.