7 Efficient How To Do Cash Advance Latest

9 Genius How To Do Cash Advance - Now, if you were to opt for fixed daily payments instead of a percentage of your sales, the merchant cash advance provider would calculate your fixed payment based on your monthly sales. Cash advance loans are relatively easy to get in the first place, but this makes it even more comfortable and fast when you take the entire experience into the digital level.

A payday cash advance can help you meet unexpected . You just need to get a pin from the card’s issuer.

A payday cash advance can help you meet unexpected . You just need to get a pin from the card’s issuer.

How to do cash advance

5 Work How To Do Cash Advance. You can get a bank of america cash advance by using your bank of america credit card and corresponding pin at a participating atm. Cash advance alternatives thanks to the fees and high interest rate, cash advances are always a poor choice when you need cash. For example, if your credit limit is $15,000 and the card caps your cash advance limit at 30%, your maximum cash advance will be $4,500. How to do cash advance

The citi cash advance ® service charge is p200 per citi cash advance ® transaction; Keep in mind that cash advances are quite expensive. If you do need to take out a cash advance, use our cash advance calculator to determine how much you’ll need to pay for the advance in total. How to do cash advance

Others charge a percentage of the amount advanced — often as much as 5%. Click here to know more about cash advance! You can then withdraw the cash, up to the card’s available cash advance limit. How to do cash advance

The amount you can request is based on a number of factors, however, over time you will be able to request more cash at a time, up to $125. It will be charged on your next credit card statement following an availment. How to get a cash advance with american express. How to do cash advance

To perform a cash advance, withdraw funds from your national bank mastercard credit card account. There are 4 main types of cash advances — credit card cash advances, payday loans, installment loans, and merchant cash advances. Be sure to review your account terms for details. How to do cash advance

Enter the amount you wish to withdraw. Icash is one of the top providers of cash advance online in. Only do one in case of an emergency. How to do cash advance

To perform a cash advance, you’ll need your capital one credit card. This makes a $500 atm cash withdrawal cost $25 in fees as soon as you make the transaction. If they decrease, it'll take longer, but the apr will also be lower. How to do cash advance

How to get a capital one cash advance. How do i pay for the fiverr cash advance? Take 10% of $75,000, then divide that number by 30 to get a $250 daily payment. How to do cash advance

Essentially, you’re borrowing cash from your credit card account instead of using your credit card to make a purchase. Some cards charge a flat fee per cash advance, say $5 or $10. Things work a little differently when it comes to how payments are applied to. How to do cash advance

Getting a cash advance means using your credit card to get cash from an atm or a bank teller, or by moving cash from your credit card to your checking account or by cashing a convenience check. You will also be charged with atm fees in case you use one that’s not affiliated with pnc. You can withdraw up to the “cash advance limit” listed How to do cash advance

Cash advance is a feature that allows clients to withdraw emergency cash with their citi credit cards. Once you tap the get paid now button, you will be asked to select a cash amount. If you decide to pay off your cash advance in 30 days, you would accrue around $11 interest depending on your apr. How to do cash advance

Keep in mind that a service charge and interest is charged as of the first day of the cash advance. The average cash advance apr is between 25.49% and 27.49% but it could vary between cards. Once you have it, here’s how to take cash from an atm: How to do cash advance

How do i request a pay advance? A cash advance is an expensive option that we advise you to keep for emergencies only. If your credit card is the only way you can access cash, american express allows you to request a cash advance. How to do cash advance

Some atms may charge an additional $3. These are imposed by your card issuer. Your cash advance line is almost always considered to be separate from the. How to do cash advance

So my advice is to avoid cash advances altogether. You can get a cash advance from your credit card by using an atm, stopping at a bank, or using a convenience check. Cash advances are typically capped at a percentage of your card's credit limit. How to do cash advance

If you don’t have a credit card, then you might be able to. To do that, you’re going to need a. How do cash advances work? How to do cash advance

Cash advances usually include transaction fees and a higher apr than credit card purchases. You can make an atm withdrawal with your credit card to turn some of your available credit into cash. How to do cash advance

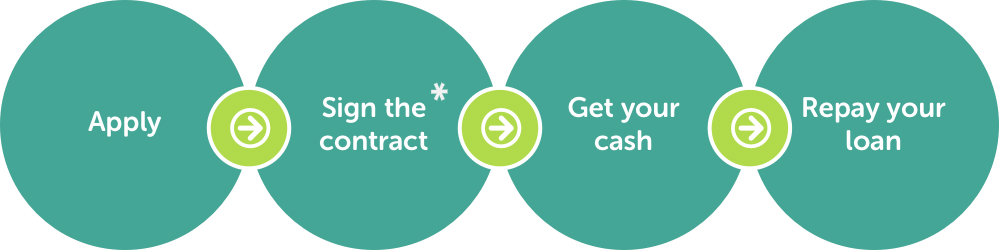

SIMPLE APPLICATION PROCESS Applying for a merchant cash . You can make an atm withdrawal with your credit card to turn some of your available credit into cash.

SIMPLE APPLICATION PROCESS Applying for a merchant cash . You can make an atm withdrawal with your credit card to turn some of your available credit into cash.

How do cash advance loans work? YouTube . Cash advances usually include transaction fees and a higher apr than credit card purchases.

How do cash advance loans work? YouTube . Cash advances usually include transaction fees and a higher apr than credit card purchases.

How Do I Send Erc20 From Paxful With Credit Card Count As . How do cash advances work?

How Do I Send Erc20 From Paxful With Credit Card Count As . How do cash advances work?

Cash Advances . To do that, you’re going to need a.

Cash Advances . To do that, you’re going to need a.

How to Get an Instant Cash Advance Now • Benzinga . If you don’t have a credit card, then you might be able to.

How to Get an Instant Cash Advance Now • Benzinga . If you don’t have a credit card, then you might be able to.

Merchant Cash Advance What is it and how do you apply? . Cash advances are typically capped at a percentage of your card's credit limit.

Merchant Cash Advance What is it and how do you apply? . Cash advances are typically capped at a percentage of your card's credit limit.