10 Skill How To Deposit Cash Into Chime Work

7 Success How To Deposit Cash Into Chime - The next time you make a walgreens ® run, you can make free cash deposits to your chime checking account. Open the chime app, tap move money at the bottom of your screen, then tap mobile check deposit, then u.s.

How To Deposit Cash To Chime Bank All information about . Cash app users can enable the instant deposit option by first making sure that there is a debit card linked to their accounts.

How To Deposit Cash To Chime Bank All information about . Cash app users can enable the instant deposit option by first making sure that there is a debit card linked to their accounts.

How to deposit cash into chime

7 Efficient How To Deposit Cash Into Chime. Send an email to chime. Alternatively, if you find yourself at one of 75,000 other retail. Cash deposit you can also choose to deposit cash at more than 90,000 retail locations. How to deposit cash into chime

Choose the account that you want to deposit the check into (checking or savings) type the exact amount written You will find this option under the “add funds.”. I was wondering how depositing cash into my chime account works. How to deposit cash into chime

Tap on the move money option. To deposit cash into your chime account, bring your cash and your chime debit card to one of 90,000 retail locations and have a cashier assist you with adding the cash to your account. Ask the cashier to make a deposit directly to your chime spending account. How to deposit cash into chime

We suggest testing this connection by pulling $1 in from your chime account to cash app (hit the add cash button). Or you can get the money within three business days for free. You can deposit a maximum of $1,000.00 every 24 hours and up to $10,000.00 every month. How to deposit cash into chime

Make easy, free cash deposits. You can make up to 3 deposits every 24 hours. Open the chime app, tap move money at the bottom of your screen, then tap mobile check deposit, then u.s. How to deposit cash into chime

The map will direct you to nearby retail locations where you can tell the cashier you’d like to deposit cash into your chime account. Chime basics how to move money into chime chime how quickly funds are available depends on the method you use. Hands down their customer service is the worst. How to deposit cash into chime

You can deposit a maximum of $1,000.00 every 24 hours and up to $10,000.00 every month. You can make up to 3 deposits every 24 hours. You can link an external bank account you own to your chime spending account in the move money section of the chime app or by logging. How to deposit cash into chime

The map will direct you to nearby retail locations where you can tell the cashier you'd like to. For joint stimulus check make sure both of your signatures appear on the back of the check. Like i read where it says you can do it at wal mart or cvs, but has anyone done it?. How to deposit cash into chime

You can deposit up to $1,000 every day or $10,000 every month, though retailer limits may vary. Of all the banking innovations we’ve seen in the past decade, mobile check deposit is my favorite. We also support ach transfers, cash deposits, and mobile check deposit. How to deposit cash into chime

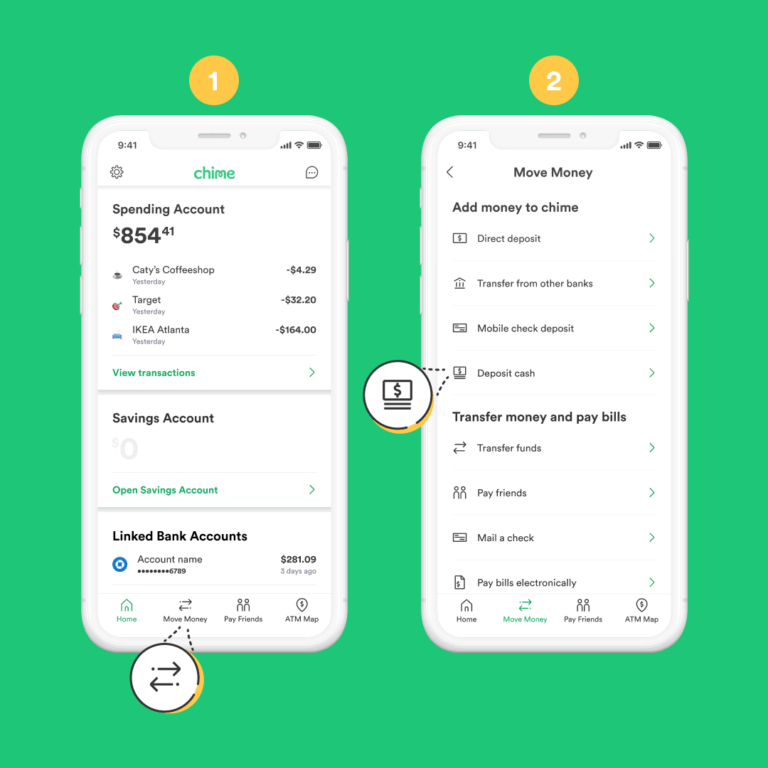

Log into the chime app and click “move money” → deposit cash. To find a cash deposit partner near you, go to the app, tap move money , select deposit cash , and tap see locations near me. Direct deposit is the easiest and most reliable way to deposit funds to your spending account, although it is certainly not the only one. How to deposit cash into chime

Can someone send me money to my chime account: Deposit your check with altra mobile deposit and it goes into your account within about a minute. Chime is one of the best online mobile banks; How to deposit cash into chime

Capture clear pictures of the front and. Chime does not accept deposits of any kind from an atm. Now you need to open up your profile. How to deposit cash into chime

Sign the back of your paper check, then write “ for deposit to chime only” under your signature. You can deposit a maximum of $1,000.00 per 24 hours or $10,000.00 per month. 31 chime deposit and direct deposit questions (quick answers!) great www.atimeforcash.net yes, you can deposit cash with chime. How to deposit cash into chime

How to move money into chime | chime great www.chime.com here's how: Although, how long does it take to add cash to chime card? Log into the chime app and click move money → deposit cash. How to deposit cash into chime

How to deposit a check online chime.this check has not been cashed and you can still attempt to cash it through another bank, but do not attempt to redeposit it to. I had 2 rebuttals opened up. Ask the cashier to make a deposit to your chime account at the register (they might refer to this as a cash reload). How to deposit cash into chime

You can add up to $1,000 every 24 hours for a maximum of $10,000. How chime works with cash app, paypal, zelle and more… by graham last updated july 5, 2021 chime bank is one of the online banks in america that offers financial services via an app. Chime defines a direct deposit as a deposit made into your account by your employer, payroll provider, benefits provider, or an online school that gives refund checks after financial aid. How to deposit cash into chime

Can I Transfer Money From Cash App To Chime All About . Chime defines a direct deposit as a deposit made into your account by your employer, payroll provider, benefits provider, or an online school that gives refund checks after financial aid.

Can I Transfer Money From Cash App To Chime All About . Chime defines a direct deposit as a deposit made into your account by your employer, payroll provider, benefits provider, or an online school that gives refund checks after financial aid.

How Do I Transfer Money From Chime To Cash App All . How chime works with cash app, paypal, zelle and more… by graham last updated july 5, 2021 chime bank is one of the online banks in america that offers financial services via an app.

How Do I Transfer Money From Chime To Cash App All . How chime works with cash app, paypal, zelle and more… by graham last updated july 5, 2021 chime bank is one of the online banks in america that offers financial services via an app.

Chime Basics How to Move Money into Chime Chime . You can add up to $1,000 every 24 hours for a maximum of $10,000.

Chime Basics How to Move Money into Chime Chime . You can add up to $1,000 every 24 hours for a maximum of $10,000.

How To Deposit Cash To Chime Bank All information about . Ask the cashier to make a deposit to your chime account at the register (they might refer to this as a cash reload).

How To Deposit Cash To Chime Bank All information about . Ask the cashier to make a deposit to your chime account at the register (they might refer to this as a cash reload).

How To Deposit A Check Online Chime All information . I had 2 rebuttals opened up.

How To Deposit A Check Online Chime All information . I had 2 rebuttals opened up.

How To Deposit Cash To Chime Bank All information about . How to deposit a check online chime.this check has not been cashed and you can still attempt to cash it through another bank, but do not attempt to redeposit it to.

How To Deposit Cash To Chime Bank All information about . How to deposit a check online chime.this check has not been cashed and you can still attempt to cash it through another bank, but do not attempt to redeposit it to.