13 Popular How To Calculate The Reserve Ratio Free

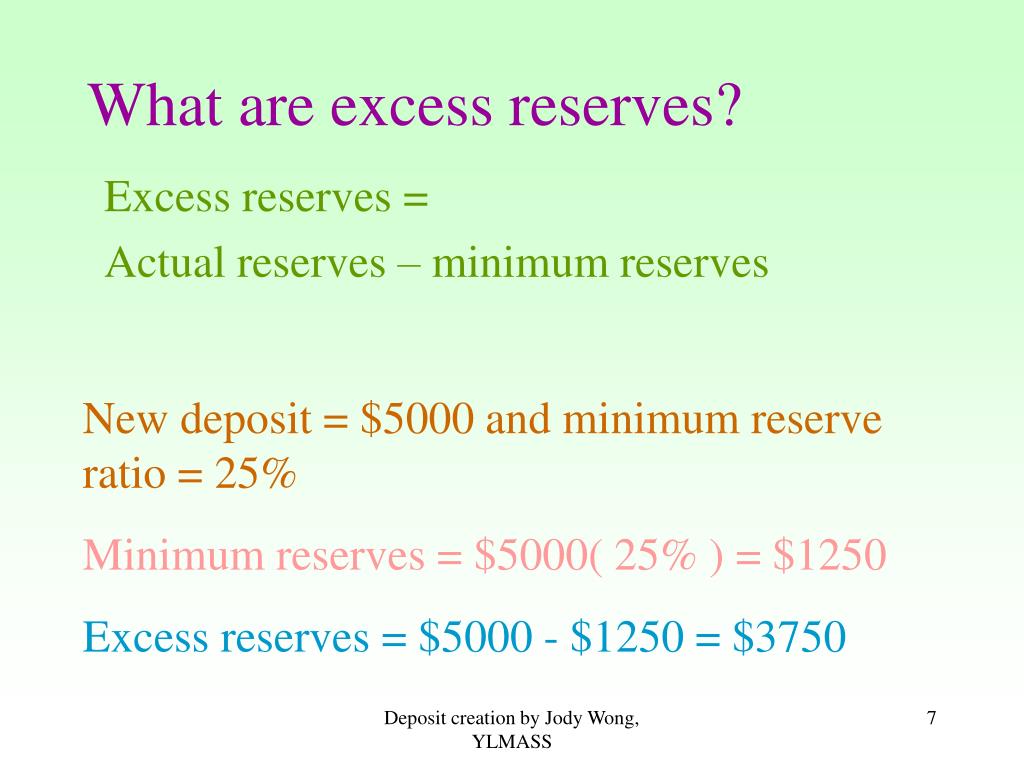

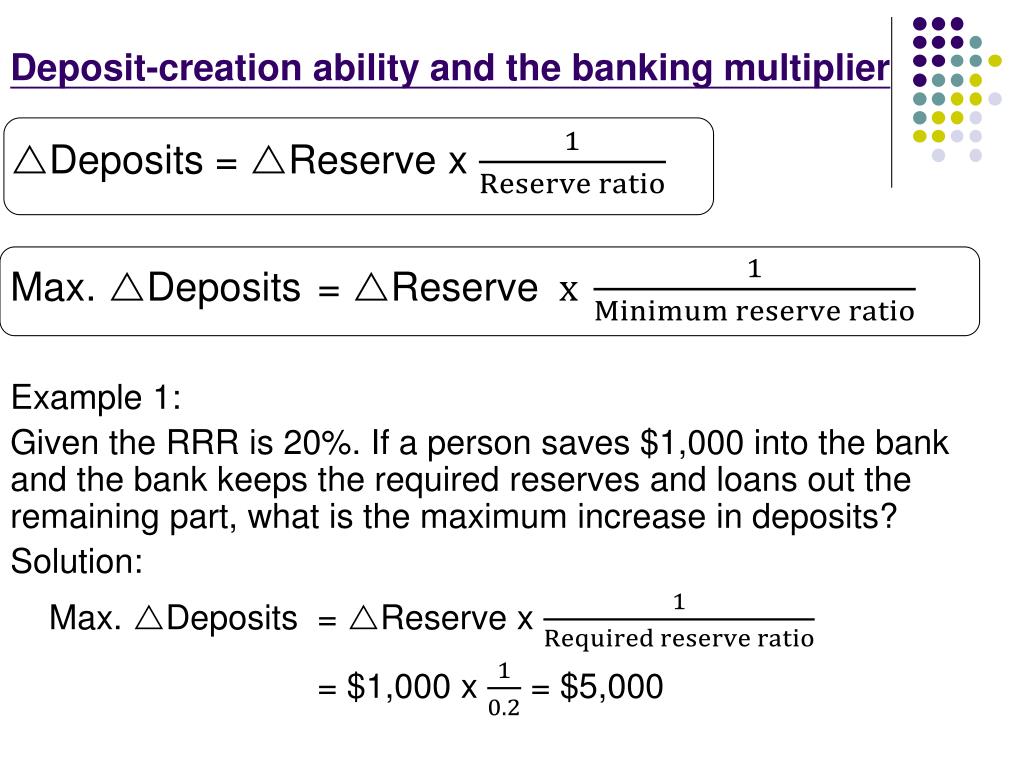

10 Sly How To Calculate The Reserve Ratio - When a bank finds itself with excess reserves, it can lend them to other individuals or banks as a loan that may need them. So, a 20% reserve ratio multiplied a $500,000 deposit five times into a $2.5 million money supply.

How To Calculate Excess Reserves From Balance Sheet . The cash drain ratio is the proportion of new deposits that individuals wish to hold as cash (∆c = c∆d).

How To Calculate Excess Reserves From Balance Sheet . The cash drain ratio is the proportion of new deposits that individuals wish to hold as cash (∆c = c∆d).

How to calculate the reserve ratio

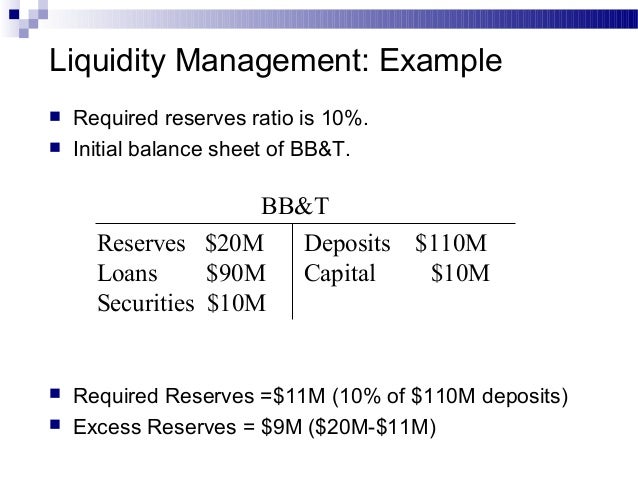

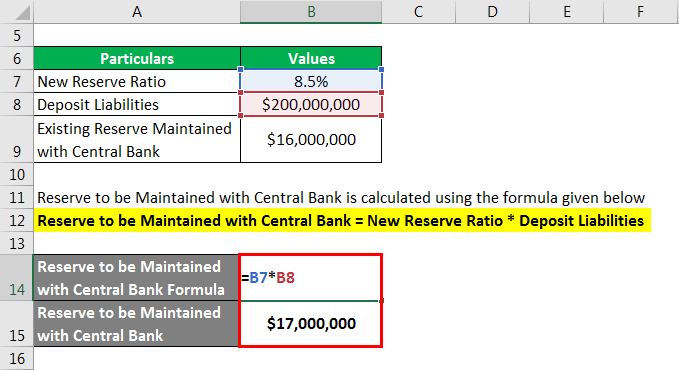

5 Genius How To Calculate The Reserve Ratio. How to calculate the required reserve ratio (rrr) balance sheet of the summer bank assets liabilities cash $ 8,000 deposited with the fed $ 6,000 loans $ 116,000 deposits $ 80,000 capital $ 50,000 total $ 130,000 total $. Rmcb is the reserve maintained by the central bank. Formula for required reserve ratio the reserve ratio is simply a fraction of deposits that banks hold in reserves.you can get the fractional reserve requirement by converting the percentage of deposits required to be held in reserves by 100 and then simplifying the fraction. How to calculate the reserve ratio

How do you calculate currency drain ratio? A bank’s reserves are calculated by multiplying its total deposits by the reserve ratio. Gross loan portfolio = usd 33,071,184. How to calculate the reserve ratio

In order to calculate the money multiplier, the required reserve ratio (r) and the currency drain (c) are taken into account. You can calculate the reserve ratio by converting the percentage of deposit required to be held in reserves into a fraction, which will tell you what fraction of each dollar of deposits must be held in reserves. Money multiplier = 1/required reserve ratio = 1/100% = 1 the country has a money multiplier of 1. How to calculate the reserve ratio

If the result is not negative, then the bank must continue to calculate its reserve ratio by adjusting its net transaction accounts. The reserve ratio, set by the central bank, is the percentage of a commercial bank's deposits that it must keep in cash as a reserve in case. How do you find the actual reserve? How to calculate the reserve ratio

Now suppose that the reserve ratio was set by the fed at 10% instead of 20%. Dl is the deposit liabilities. Money multiplier is the number by which a change in the monetary base is multiplied to find the change in the amount of money. How to calculate the reserve ratio

How to calculate reserve ratio? Money multiplier is the number by which a change in the monetary base is multiplied to find the change in the amount of money. This page provides summary information on how to determine the reserve requirements of an individual credit institution subject to the ecb's minimum reserve requirements. How to calculate the reserve ratio

A more detailed description of the system can be found in the ecb publication entitled the single monetary policy in the. No money creation is possible because, in response to an increase in bank collaterals. The genuine takeaway here is to have the option to explain why the specific. How to calculate the reserve ratio

How to calculate the minimum reserve requirements. In order to calculate the money multiplier, the required reserve ratio (r) and the currency drain (c) are taken into account. Calculate money multiplier for the economy. How to calculate the reserve ratio

Simply so, how do you calculate required reserves? The bank’s required minimum reserve is. 1 nonprofit operating reserve1 ratio by nonprofit reserves workgroup, nccs/cnp, the urban institute; How to calculate the reserve ratio

Money multiplier x change in monetary base is equal to the change in quantity of money. Identify adjustment amounts identify the current exemption amount and low reserve tranche amounts that will be used to adjust net accounts by checking the federal reserve board of governors website. Which will have a larger impact on the money multiplier: How to calculate the reserve ratio

Introduction every organization should show up at its own reason for what it thinks sufficient for financial status. Where rr is the reserve ratio. Click to see full answer. How to calculate the reserve ratio

The following equation is used to calculate a reserve ratio. The required reserve ratio is the fraction of deposits that the fed requires banks to hold as reserves. Loan loss reserve ratio = 499,038 / 33,071,184 = 1.51%. How to calculate the reserve ratio

Rr = rmcb / dl. How do you find the money multiplier with reserve ratio and currency […] The excel calculation and data in the picture of the example above can be found in the link here: How to calculate the reserve ratio

Here $100 billion is held as cash, that is 1/5 of all deposits in the economy. Money multiplier x change in monetary base is equal to the change in quantity of money. With the financial information above, we can calculate loan loss reserve ratio as below: How to calculate the reserve ratio

Loan loss reserve = usd 499,038. For example, suppose abc bank has $1,000 million in deposits. The reserve ratio is the percentage of deposits that the central bank requires a bank to keep on hand at a central bank. How to calculate the reserve ratio

Next, calculate the required reserve ratio by dividing the fraction of deposit maintained in the reserve (step 3) by the total amount of deposits received (step 1) by the bank For example, if a bank’s deposits total $500 million, and the required reserve is 10%, multiply 500 by 0.10. How to calculate the reserve ratio

PPT Process of Multiple Deposit Creation in a Fractional . For example, if a bank’s deposits total $500 million, and the required reserve is 10%, multiply 500 by 0.10.

PPT Process of Multiple Deposit Creation in a Fractional . For example, if a bank’s deposits total $500 million, and the required reserve is 10%, multiply 500 by 0.10.

Reserve Ratio Formula Calculator (Example with Excel . Next, calculate the required reserve ratio by dividing the fraction of deposit maintained in the reserve (step 3) by the total amount of deposits received (step 1) by the bank

Reserve Ratio Formula Calculator (Example with Excel . Next, calculate the required reserve ratio by dividing the fraction of deposit maintained in the reserve (step 3) by the total amount of deposits received (step 1) by the bank

PPT Economics PowerPoint Presentation, free download . The reserve ratio is the percentage of deposits that the central bank requires a bank to keep on hand at a central bank.

PPT Economics PowerPoint Presentation, free download . The reserve ratio is the percentage of deposits that the central bank requires a bank to keep on hand at a central bank.

Solved Consider The Following Situations A. Bank Reserve . For example, suppose abc bank has $1,000 million in deposits.

Quiz & Worksheet Required Reserve Ratio . Loan loss reserve = usd 499,038.

Quiz & Worksheet Required Reserve Ratio . Loan loss reserve = usd 499,038.

Lecture 33 Notes . With the financial information above, we can calculate loan loss reserve ratio as below: